Your daily dose of Product Management Goodness

Want to know more?

We would love to hear your questions and suggestions for topics you would like to see covered in our future blog posts, so don't be shy and get in touch!

Step 4

Forecasting for a new product or service is challenging when we have no historic or foundation data to work from. In our six step process we’ve so far considered:

Step 1 of 6 Find the total available market

Step 2 of 6 Identify key segments to do your research

Step 3 of 6 Understand the lifecycle component

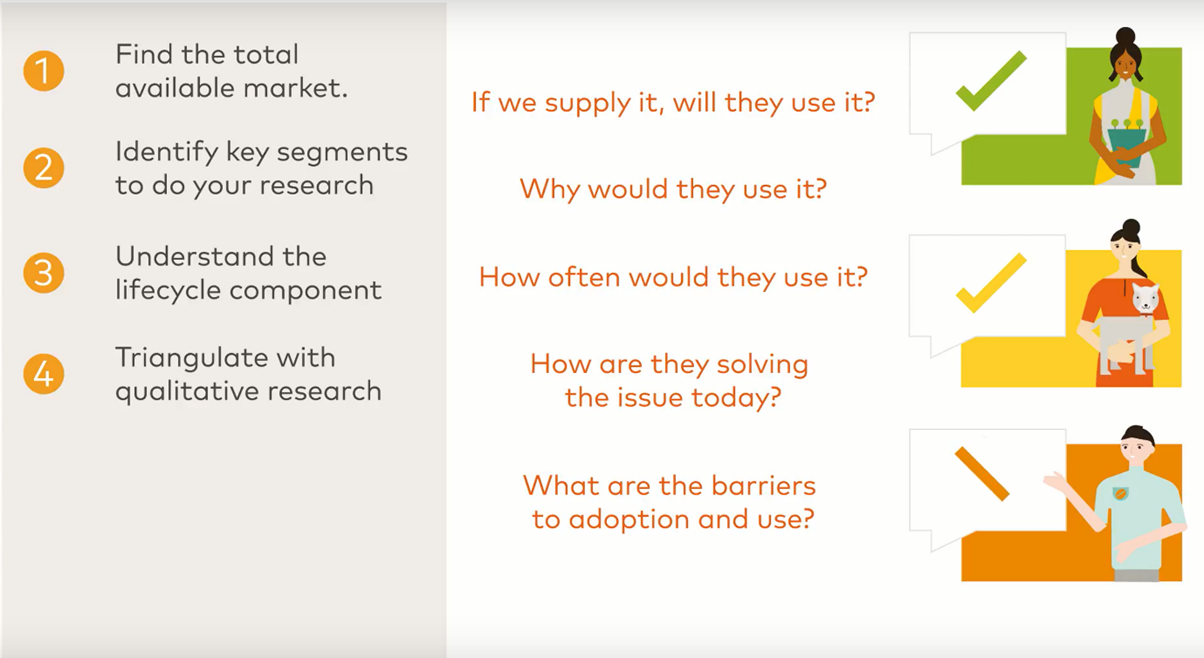

The next step is: Step 4 of 6 Triangulate with qualitative research

There’s no substitute for direct market research. Test the proposition with a minimum of three client groups in your target market and also with other relevant stakeholders such as support functions or other product teams. Get answers to questions such as:

If we supply it, will they use it?

Why would they use it?

How often would they use it?

How are they solving the issue today?

What are the barriers to adoption and use?

From this, make an estimate – how many of my target market are likely to adopt.

read more

Step 3

Forecasting for a new product or service is challenging when we have no historic or foundation data to work from. In our six step process we’ve so far considered:

Step 1 of 6 Find the total available market

Step 2 of 6 Identify key segments to do your research

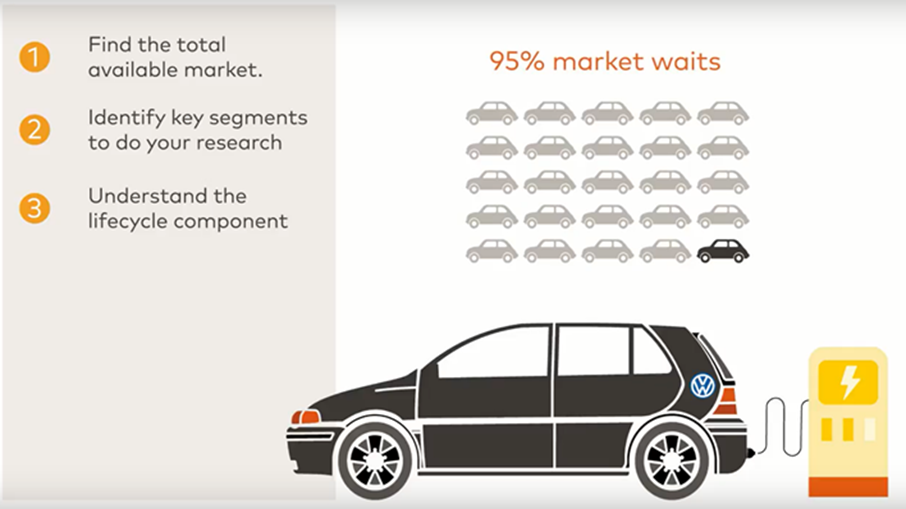

The next step is: Step 3 of 6 Understand the lifecycle component

Understand where the product or service sits on a lifecycle or adoption curve. This will hugely influence demand. For example, think of the electric car – the Total Available Market is all car owners, but because it’s new and innovative technology, we know that only a 5% innovator group is likely to be interested in buying this product initially. In contrast, a car such as a Diesel-powered SUV is in decline in European markets because of new emissions legislation, so we wouldn’t plan to launch in a declining market.

read more

Step 2

Forecasting for a new product or service is challenging when we have no historic or foundation data to work from. In our six step process we’ve so far considered:

Step 1 of 6 Find the total available market

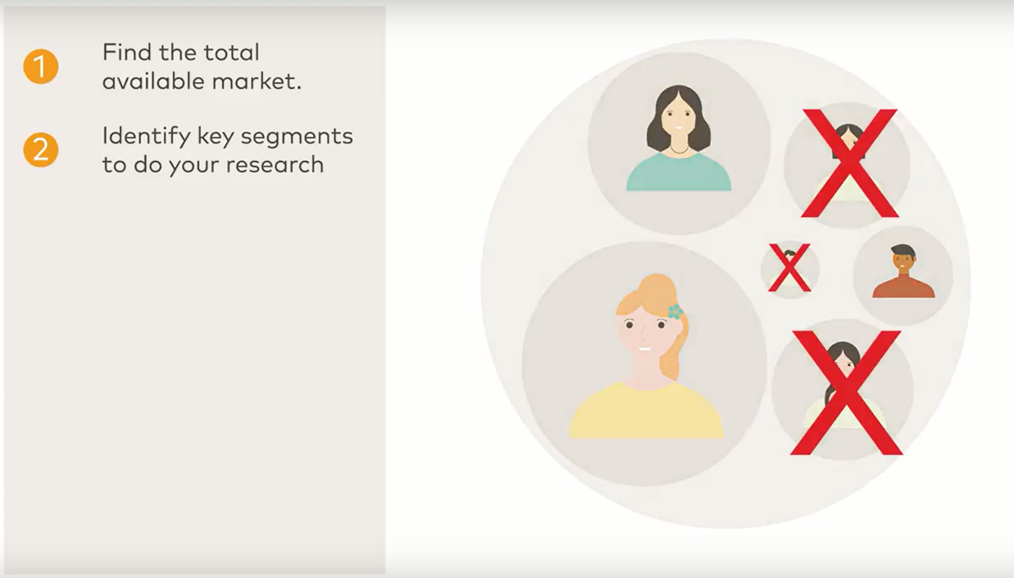

The next step is:

Step 2 of 6 Identify key segments to do your research.

Research is expensive and time consuming. Almost always, it’s better to identify two or three groups within the total available market and focus our research efforts with them. Research group candidates should include groups with the most pressing need for the solution.

read more

Step 1 of 6

How many clients will use a new product or service? It’s a difficult question to answer, but if we can’t put an estimate on product demand then we cannot scale our delivery or support teams. Forecasting for a new product or service is challenging when we have no historic or foundation data to work from. Over the next few days we’ll look at a six step process to help:

Step 1 of 6 Find the total available market

The first step is to work out how many customers could use your product or service – the maximum number of clients across your markets if there was 100% take up (known as the total available market). Using this technique, we calculate the back stop number - a number that represents 100% market saturation. We can break this down by regions, sectors, customer types, etc.

read more

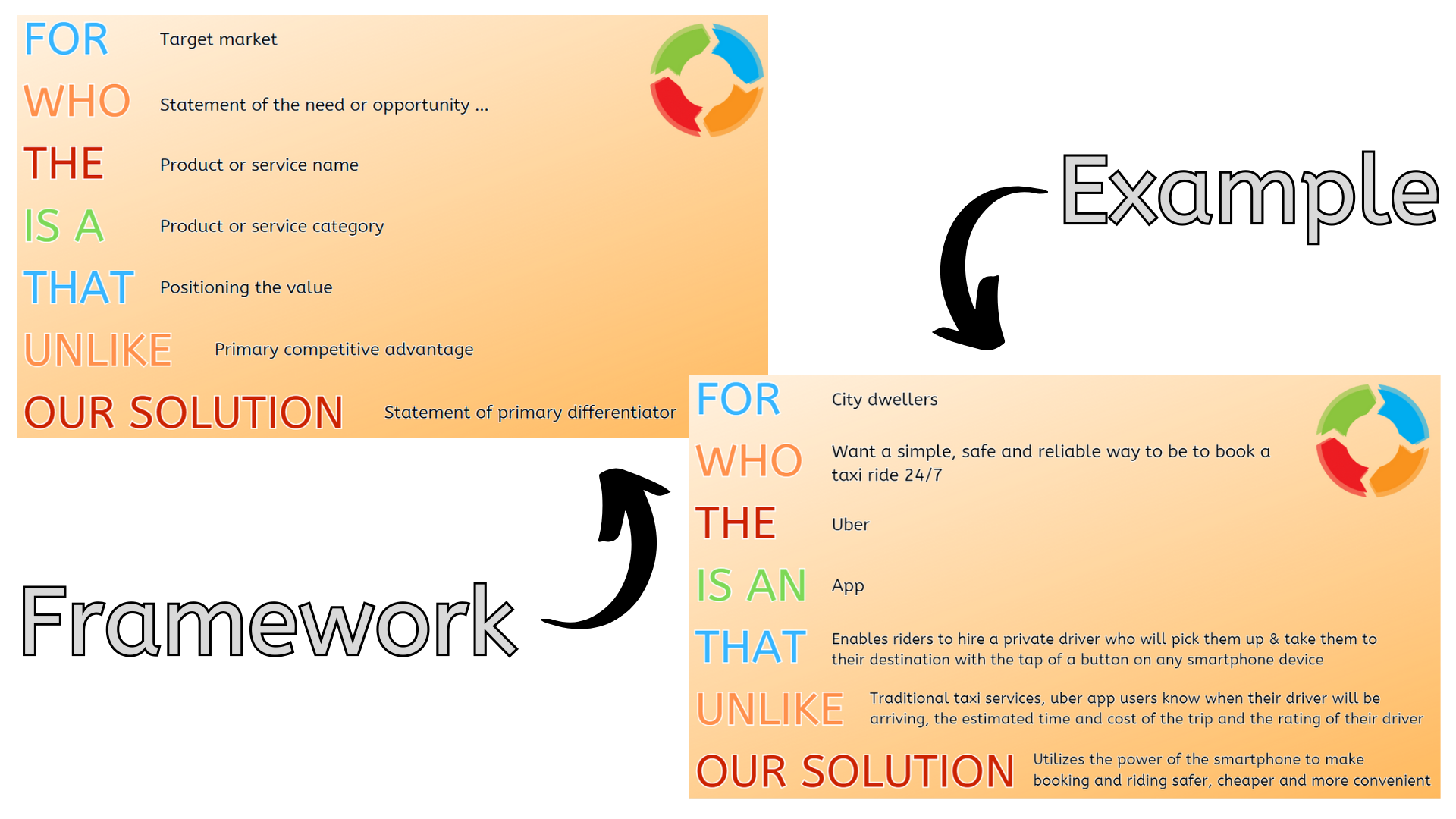

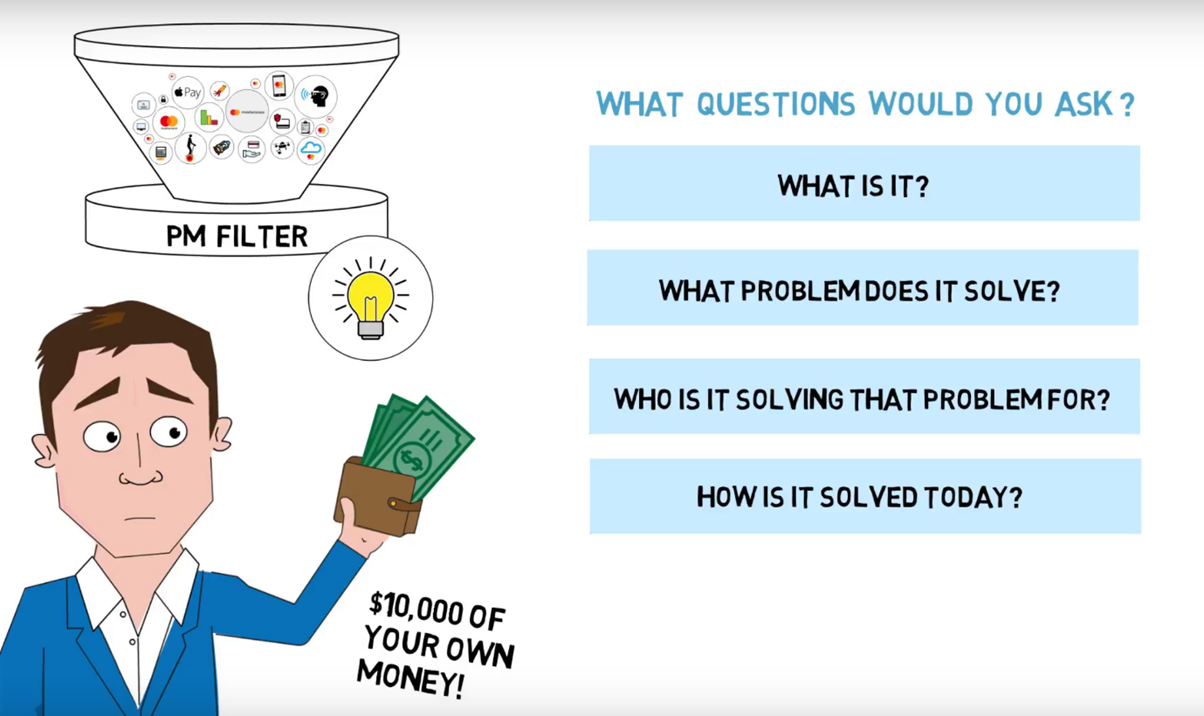

Start with the problem

So many product managers start at the wrong end of ideation- they start with a solution and then look for the market problem. Think about like this; if you were presented with a new product idea right now and were asked if you’d spend your own money developing it, what questions would you ask? Here are my starter questions:

• “What is it?”

• “What problem does it solve?”

• “Who it is solving that problem for?”

• “How is it being solved today?”.

Let’s pause for a moment on those four questions. They’re powerful. Think of products that have failed – the reason for their failure will at least in part sit within those questions. These questions are also great to push back out to idea originators. It helps you test their thinking before the idea gathers momentum and becomes yet another product for you to deliver. Remember to START WITH THE PROBLEM.

read more

Technique 6

Technique number 6: TEST MARKETING

And finally, there’s test marketing. The product and its marketing plan are exposed to a carefully chosen sample of the population before its full-scale launch. It’s conducted in real-life buying situations and can last from few weeks to several months. Due to its high cost, however, test marketing is more suitable for fast moving packaged goods

read more

Technique number 5

Technique number 5: SURVEYS

POSTAL SURVEYS, PHONE INTERVIEWS, INTERNET SURVEYS

Postal, phone and Internet surveys have the greatest potential for causing resentment on the part of those surveyed. And very low (less than 1%) response rates.

Additionally, respondents may not be representative of the market and can misdirect you.

read more

Technique number 4

Technique number 4: PERSONAL INTERVIEWS

Personal Interview research is a face-to-face meeting. People are more willing to respond in person, but can often tell you what they think you want to hear.

Participants tend to say the first thing that comes to mind or what they think they want. Once you look deeper into it you notice that there’s a lot more that must be uncovered, sometimes what they think they want or why they think they choose a product or service isn’t always the true motivation.

read more

Technique number 3

Technique number 3: FOCUS GROUP

In focus group research, 6 to 12 people are brought together by researchers to discuss a specific situation or reactions to a product. Questions are asked to the group, who are free to discuss the topics with each other. One key issue is that the research is reliant on the interpretation of group discussion. This can raise questions about observer dependency and validity.

read more

Check out the Archive