Your daily dose of Product Management Goodness

Want to know more?

We would love to hear your questions and suggestions for topics you would like to see covered in our future blog posts, so don't be shy and get in touch!

Technique 2

This week we’re running through the techniques for market validation.

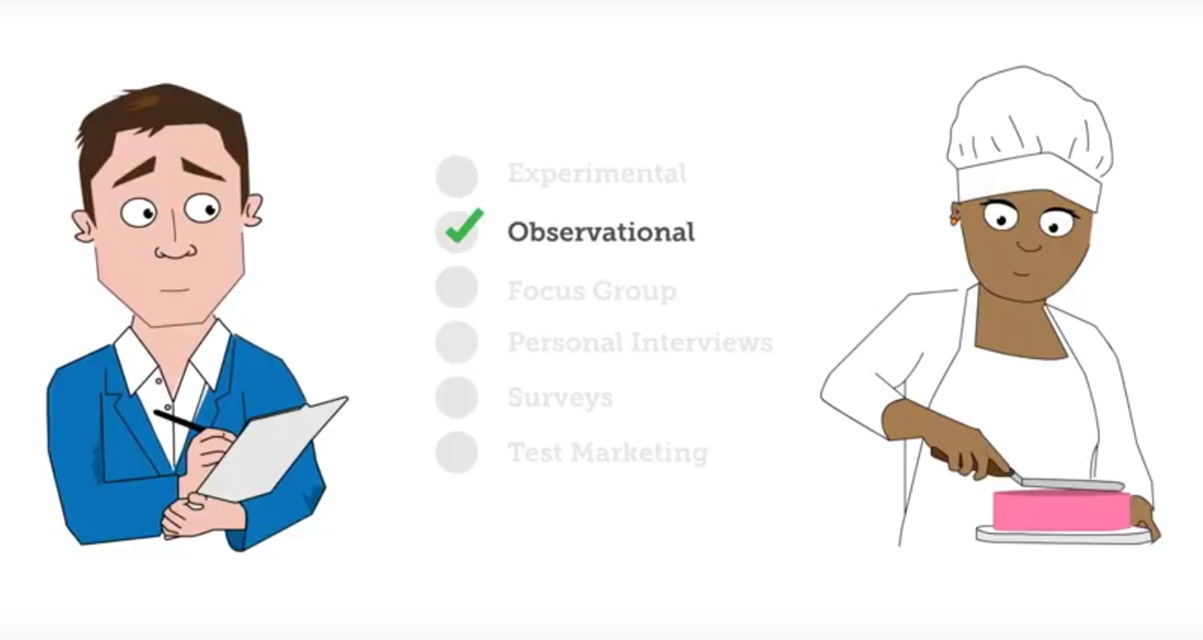

Technique 2 - OBSERVATIONAL

In observational research actions of people are watched either by cameras or observers, typically in a natural environment. Using this technique, product managers can see how clients respond to different stimuli and situations. The benefit is that clients are more likely to demonstrate typical behaviour in a natural setting rather than ‘ideal’ behaviour in a simulated or artificial environment. However, what it cannot show is why customers behave in a certain way – their attitudes or motivations.

read more

Technique 1

This week we’ll run through the techniques for market validation. We will describe 6, but feel free to highlight techniques you use

Technique 1 - Experimental

In experimental research, we observe the results of changing one or more marketing variables while keeping certain other variable constant. Are groupings of features. They describe the value that a customer can gain from using the features within a theme.

A theme describes the core value and each feature is a proof point of how that value is being delivered.

read more

Life cycle thinking

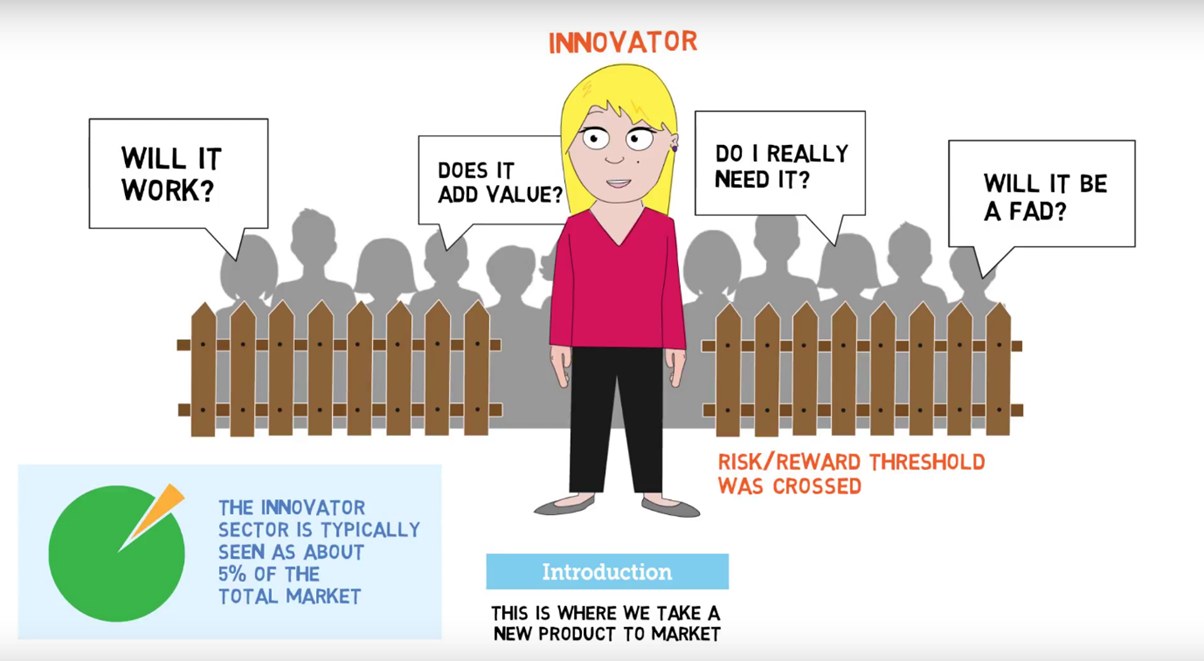

Life cyle thinking is something that’s often overlooked by Product Managers. In their rush to launch they neglect to consider how the market will shape and grow. Think about taking a new product to market . Quite naturally, expectations and excitement run high on launch day. But a few weeks later those highs often feel like a distant memory as sales don’t meet projections and the product runs the risk of being perceived as a flop. An understanding of the introductory phase can save lots of heartache!! There are a couple of critical learnings:

1. Most customers wait for others to try new products – When a product comes to market, most customers see risk – Will it work? Does it add value? Do I really need it? Will it be a fad? Consequently they wait; let others take the risk whilst they see if something of real substance materialises. The risk takers, known as ‘innovators’ buy in. They are likely to have more pain around the problem your product solves, so find themselves willing to try out your solution – their risk/reward threshold was crossed.

2. As a consequence the full market is not available – The innovator sector is typically seen as about 5% of the total market. Think about the consequences of this; a new product with a total market size of $100M typically only has access to $5M of that market at first. Miss this and point and revenue forecasting will at best be ambitious!

read more

Product Launch

Preparing for market launch is a complex task. Product managers should make this task a little easier with the use of launch checklists. These focus on five main areas:

1) Is the product ready?

2) Does it satisfy a true market need?

3) Are all processes required to support it in place? (e.g. operational support and pricing)

4) Is the market or channel ready to receive the product? These are the sales and marketing teams who are willing and able to handle this product and have an effective delivery plan.

5) Are our customers ready? Do our consumers have all that they need to be able to access and successfully use the new product?

Keep in mind, that a product launch is not a short-duration, high-intensity event that is concentrated near the end of product development; instead, it’s a long-term activity that starts during product planning and gradually ramps up to a successful, on-time launch, based on full readiness of many disparate elements, systems and cross-functional organizations.

read more

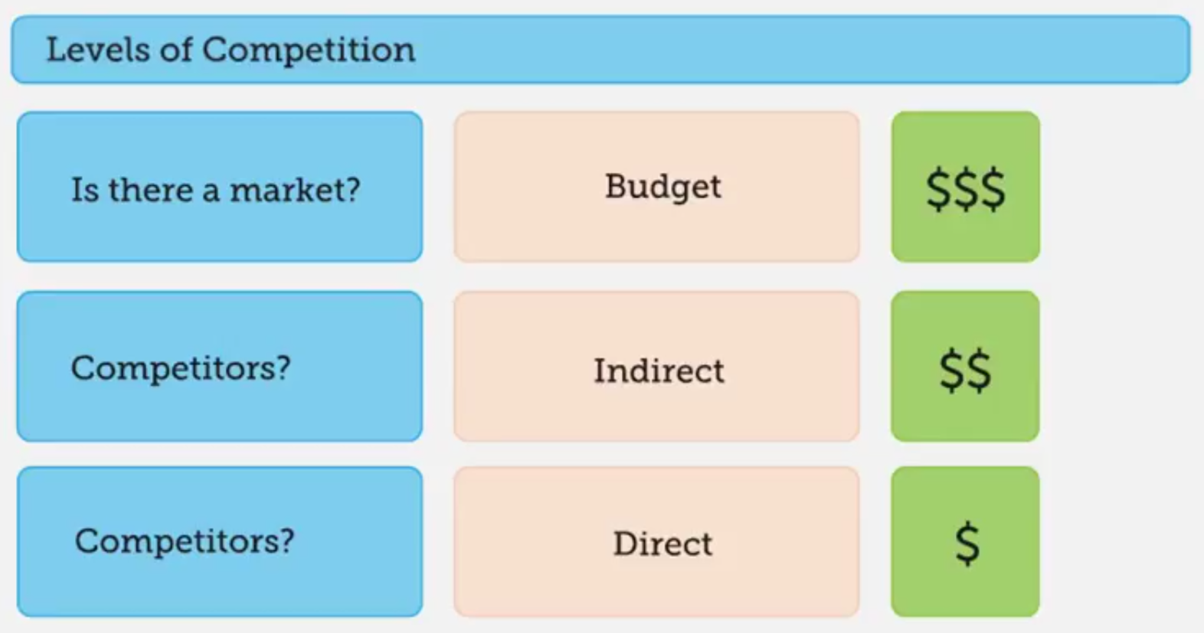

Level of competition

I was talking to a team who describe their product as having “no competition”. Great news? Perhaps, but think about it like this.

We should think about levels of competition.

1. We might face products similar to ours from competitors that look a lot like us. These are direct competitive threats - think audi vs bmw vs mercedes.

2. Sometimes the competition is less obvious. Its other ways that our customers can solve the problem that we help them solve. These are indirect competitive threats – think car vs plane vs video conferencing

3. Occasionally we see our product having no competition. This sounds great, but we should be cautious. No competition might mean you’re first to market, but it might also mean that there really no market. Even being first to market isn’t without risk. History is littered with examples of products and businesses that got there first, but didn’t thrive – think Palm in the PDA market, the Betamax format in the video market or Atari in the games console market. All three were first to market. All three failed to capitalise on first mover advantage.

read more

A quick tip on market research

A quick tip on market research.

With all research techniques we should remember that what customers do and say and think is not always consistent. I may LIKE the yellow car. It might be my FAVOURITE colour, but I might BUY the blue car – it stays looking clean, it’s easier to sell, it’s less a risky choice. So remember to ask the same question from many angles and look for consistency:

What is your favourite colour?

Which colour would you choose?

Which will be most popular?

Which colour would your partner choose?

Which colour would you buy?

read more

The Approach

Watching paint dry or being presented with an endless list of features that describes everything a product manager is planning to add to their product over the next twelve months. They compete for the title of “Most boring thing I can imagine doing”. From a customer or an internal stakeholder perspective, trying to deduce where the value might be in the list of the 100 features the product manager plans to add is mind-numbing. And the risk? All that hard work from development gets lost as customers simply can’t see the value to them. A better approach is to group features into themes – each theme conveying the core value and the majority of features demonstrating delivery of that value.

read more

Point of Difference

What’s your point of difference?

I’m working with a company whose strategy for domination is to build a multitude of similar products so that one of their offers is bound to grab your attention if you are in their market. At first glance, it might seem a strange strategy (vs focusing energies on building one world class product), but with the right infrastructure it can work well – think how the VW Audi group offer a range of cars from the Skoda to the Bugatti with a shared platform approach across many products. The key to making this approach work is two-fold:

1. Each product needs a different purpose (e.g. we see skoda as different to audi)

2. Sharing common components make the model efficient.

read more

Life cycle Model

Got this question from a product manager today “I understand the lifecycle model, but how do I know what stage of the lifecycle my product is at?” Here’s my 50,000 foot view:

You’re in the introductory phase if the majority of your target market has just about heard of your product, and a very small percentage would actually buy “What the hell is an autonomous car?”

You’re in the growth phase if the majority of you target market understands your product and think of it that might be something to consider whilst a significant minority want to buy “I’m going to take a look at the electric car”

You’re in the maturity phase if the majority of your market see your product as a normal choice “It’s either petrol or diesel for me”

You’re in the decline phase when the majority of your market think your product is old “You’re buying a horse!!”

read more

Presentation Skills

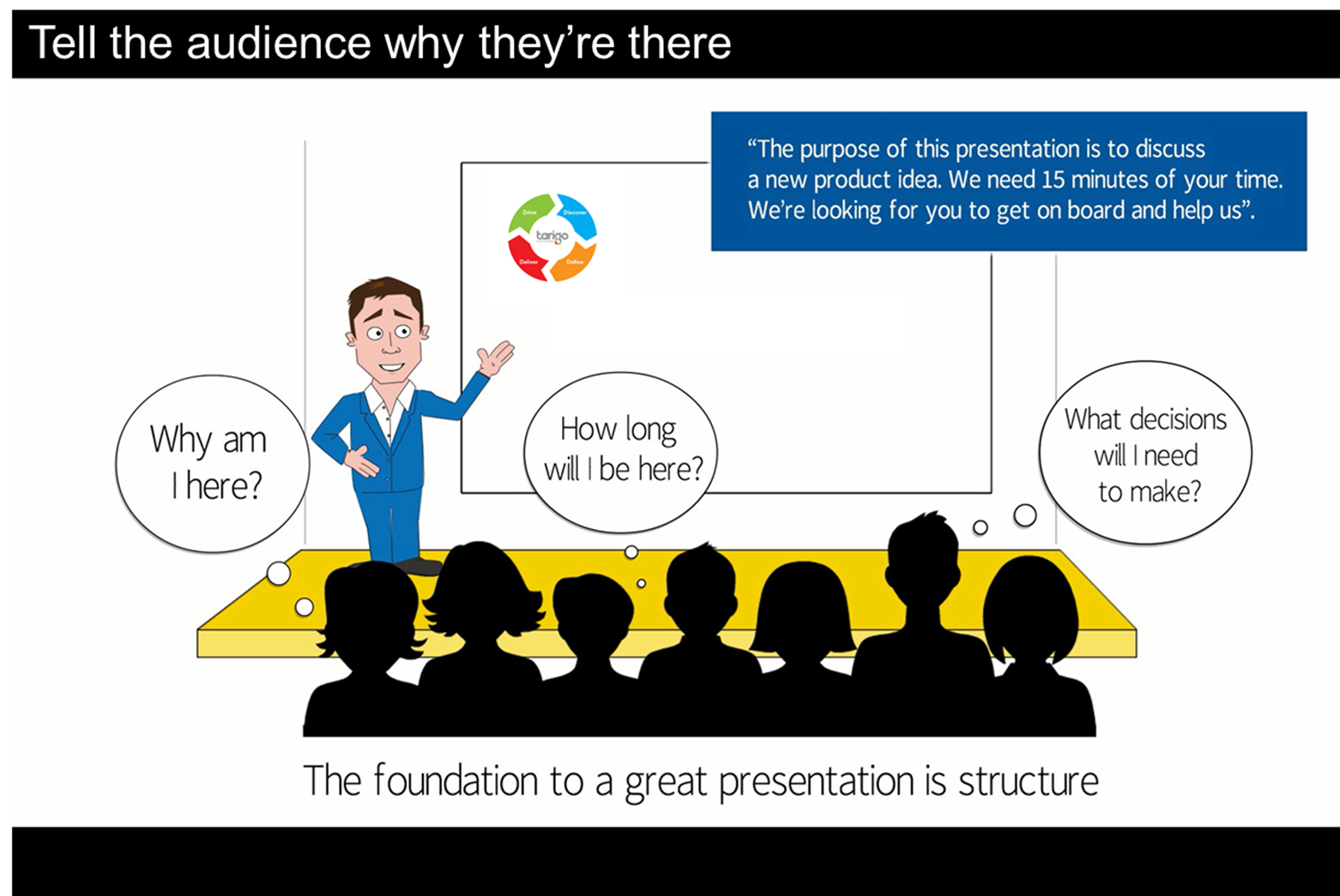

Presentation skills; it feels like some have them and some don’t! But for a product manager, being able to present with clarity and conviction is a skill worth working on. Your bright new product idea could fall at the first hurdle if the review team simply don’t understand it or pay enough attention because of how you present. But many product managers fall at the first hurdle – their presentation unravels from slide one as they fail to get the introduction right.

So how should your presentation start? The key is structure; your audience want to know some basics. “Why am I here?”, “How long will I be here?”, “What decisions will I need to make?” So tell them! Whoever the audience, take the lead from word one, slide one. You give the audience confidence that you’re in control.

read more

The perfect PM

What do you look for in a product manager? We often get asked to assess a potential PM candidate. Outside of their PM knowledge, these are the attributes that I look for:

Communicates powerfully, clearly and credibly

Solves problems and analyses issues

Innovative and entrepreneurial

Inspires

Collaborates and can work I nor drive a team

Builds relationships

Inspires and motivates others to high performance

Disciplined

Focuses on results

Drives for results

Practices self-development

What do you look for in the perfect product manager?

read more

Process

Process. Some Product Managers love it, whilst most of us grudgingly accept it as something we should do . It’s like eating your greens or walking your 10k steps a day. But skip the process and, just like regular exercise or healthy eating, you’ll soon start to find out why it’s important. Without process we introduce randomness – ideas get selected, products get built, and prices get set without clear, consistent and coherent rationale. We end up with an incoherent product set that can confuse our customers. And once a process is broken then everyone feels justified in breaking it a little more.So, eat your greens, walk every day, and follow your PM process. They’re all good habits!

read more

Market Research

How do you interpret market research?

I’m currently doing some market research for a new b2b product and trying to answer the most basic question “should we build it” by gathering customer feedback on the problem that the new product solves. So far the feedback has mostly been along the lines of “We’re mildly interested”. So what does that mean? It could mean a number of things (they’re the wrong audience, they don’t understand the problem statement, etc), but fundamentally it means that the research group we’ve spoken to are not going to be knocking our door down to get to the new product. “Mildly interested” does not get them awake in the night worrying about the problem you solve or rushing to get that PO in place to buy your product. When conducting b2b market research look for three indicators of interest:

1. “How much will it be”

2. “When is it coming to market”

3. “Give me the details about how it works”

These are true signals of interest

read more

Meeting Customers

When did you last meet customers?

I’m amazed how many product managers in the b2b space have no/limited customer contact. Remember, without customer contact you’re doing no more than guessing. Product manager does not need an opinion, they need market gathered evidence.

read more

Find the 3 A.M. problem

Find the 3 A.M. problem

We work with many teams who want to innovate more – find the next big thing that will propel their business forward. Often these conversations focus on the product “What new shiny thing can we take to market?”. This is not the right place to start. In the B2B world, great products are built on solving real world problems. The bigger the problem, the more motivation there is to fix it. Obvious really, but missed by so many teams on their quest to uncover a winning idea. So, next time you’re looking to innovate, start with this question “What problems are keeping our customers awake at night?”. Problems that wake someone at 3am, are problems they’re motivated to solve

read more

What does a product manager do?

What does a product manager do?

Our role can be quite complex and difficult to describe. But if we don’t have a clear purpose then we run the risk of being misplaced in our business (step forward all those product managers who are really sales support or project managers, ....).

Here’s a definition that might help. “Product managers reduce the risk of launching a product flop and increase the success of products in market”. So what does that mean? Well, product failure occurs in every sector. By using a professional pm framework a product manager reduces the risk of a potential product flop getting to market (we assess before we launch) and then by using the same pm framework, they ensure that existing products remain successful for longer (we continuously improve products). If there’s a 25% product failure rate in your industry and your pm skills have reduced that to 5% in your business then that’s great product management.

read more

Check out the Archive